View More

Looking for Professional Indemnity Insurance?

Our partners at insurance.com.au offer combined Professional Indemnity, Public and Products Liability insurance under one easy-to-manage Civil Liability policy.

This offer includes combined $1M Civil Liability (Professional Indemnity) and $10M Public and Products Liability Cover.

Want to learn more about the Civil Liability (PII) insurance policy? Visit www.insurance.com.au/cmasa

Need Assistance? Watch our online video tutorial!

Need assistance quoting your Civil Liability (PII) cover? Watch the YouTube walk-through quote guide in Mandarin here, or in English here.

Looking for Building, Contents or Glass cover?

insurance.com.au offers a comprehensive combined building, contents and glass insurance solution to CMASA members at a competitive price.

To learn more about how to purchase this cover online, you can view the insurance.com.au website here, or watch their YouTube tutorial that shows you how to quote building, contents and glass cover in Mandarin here, or English here.

Contact the insurance.com.au team

Ask insurance.com.au about how to purchase cover! Contact the team on 1300 468 730, or support@insurance.com.au. insurance.com.au has Mandarin speaking staff ready to assist you!

This article has been prepared by insurance.com.au Pty Ltd ABN 27 163 909 073, an Authorised Representative (AR Number 443422) of Insurance House Pty Ltd ABN 33 006 500 072 AFSL 240954. A copy of Insurance.com.au Pty Ltd’s Financial Services Guide (FSG) is available here.

The information in this article is of a general nature and does not take into account your individual objectives, financial situation or needs. Before making a decision based on any of the information, you should consider whether it is appropriate to your particular circumstances. You should also obtain and consider the Product Disclosure Statement (PDS) and, where available, Target Market Determination (TMD) before making any decision to acquire a financial product.

The information is current at the time of publication. While every effort has been made to verify the accuracy of the information, insurance.com.au Pty Ltd, its officers, representatives, employees and agents disclaim all liability (except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this material for any loss or damage suffered by any person directly or indirectly through relying on the information.

For a copy of the insurance.com.au Privacy Policy click here.

Introduction of MEBO Group

View More

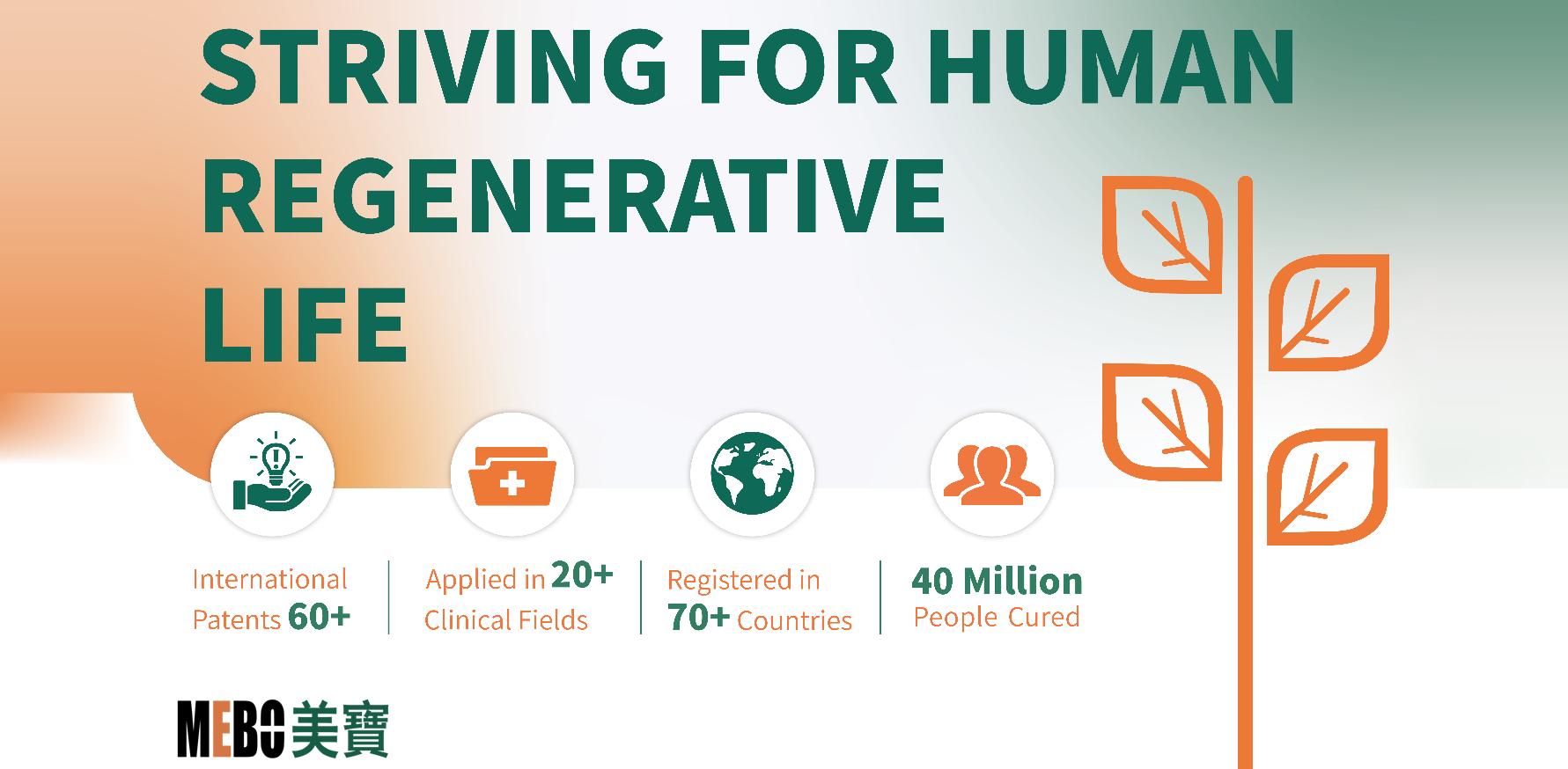

Introduction of MEBO Group

—————— Advancing Regenerative Life Science and Technology

MEBO International Founded In 1987, MEBO International is a multinational enterprise specializing in the development of regenerative life science. Today, over 200,000 doctors from over 70 countries are using our products and technology in 20 medical fields, and more than 40 million patients afflicted with wounds have been cured. Over the past decades, MEBO International has developed a comprehensive product line including medicine, medical device, dietary supplement, and skincare product. All products provide premium solutions to the market with unique positioning and scientific evidence behind the claims. MEBO International, a mission-driven enterprise striving for human regenerative life.

Striving for human regenerative life is the faith and mission of MEBO International and also the eternal drive of MEBO International moving forward. With the clinical practice and development of regenerative life science and technology, MEBO International can meet the high expectations of the world people towards life, such as extending human life and overcoming refractory disease, tremendously improving the quality of human life.

Outpatient Medical Record Management System

View More

Outpatient Medical Record Management System Introduction

This system offers the following core functionalities:

- New Patient Registration

- Patient Management

- Medical Record Management

- Insurance Claim Documentation & Printing

- Herbal Medicine/Pharmaceutical Management

- Individualized Prescription Templates

- Statistical Reporting

Full Compliance with Australian Insurer TCM Audit Standards

Designed specifically to meet Australian insurer requirements for Traditional Chinese Medicine (TCM) claims, our system features:

Core Modular Design & Key Compliance Safeguards

Ensures seamless integration with Australian insurance reimbursement systems (e.g., HICAPS) and adherence to industry regulations:

Automated compliance validation reduces claim rejection rates (currently averaging 18% in Australian TCM clinics)

Meets cross-regulatory requirements of TGA, AHPRA, and PHIAC

System Value Proposition

Guarantees end-to-end audit readiness from clinical documentation to insurance reimbursement, with enforced controls for critical audit focus areas:

- Diagnostic evidence chain integrity

- TGA-compliant herbal substance legality

- PHIAC-mandated fee transparency

- Audit-proof documentation trail

This design ensures uninterrupted claim processing and successful insurer audits for Australian TCM practices.

System login address: http://client.gamhservice.com/